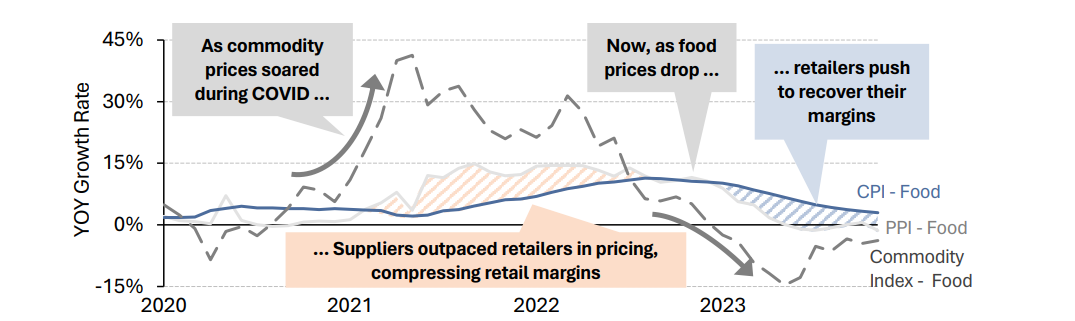

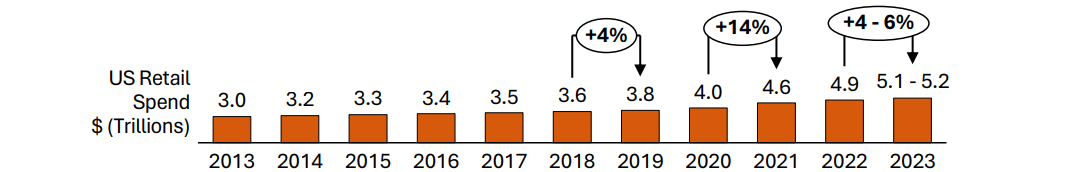

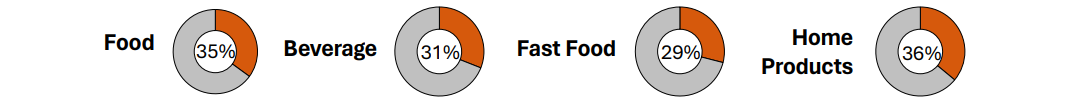

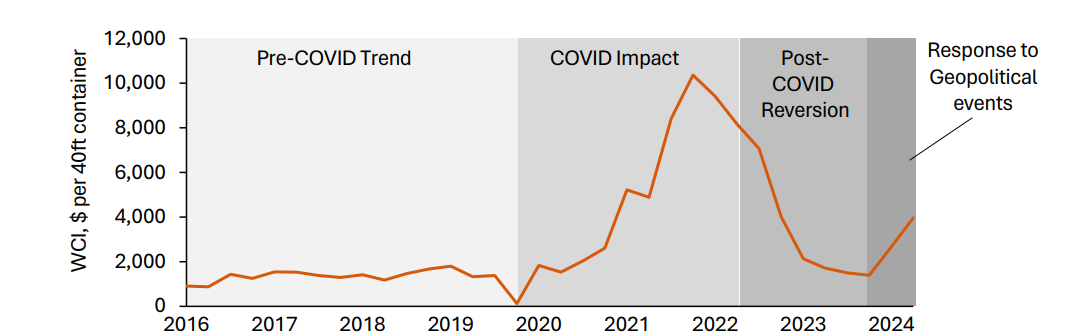

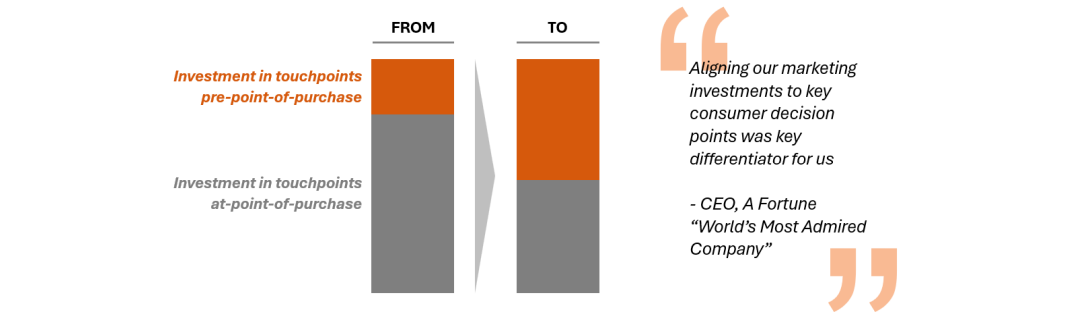

Summary:After a recent inflationary period, consumers have tightened their belts. This has created upstream tension between retailers and suppliers over margin sharing arrangements. We suggest that while margin splits are an important point of contention, there is a bigger opportunity: suppliers and retailers can collaborate to grow overall consumer spend.

From Conflict to Cash Flow

Why a Retailer-Supplier Truce on Margin Split Disputes Makes Dollars and Sense