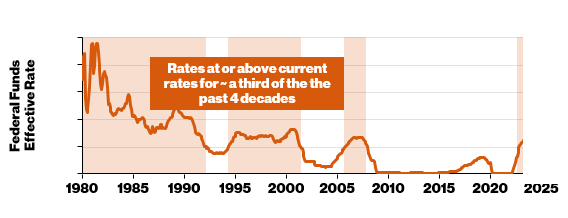

1. “Federal Funds Effective Rate.” Federal Reserve Bank of St. Louis, fred.stlouisfed.org/series/FEDFUNDS. Accessed 19 Jan. 2024.

2. Desjardins, Jeff. “Visualizing 40 Years of U.S. Interest Rates.” Visual Capitalist, visualcapitalist.com/sp/visualizing-40-years-of-u-sinterest-rates/. Accessed 19 Jan. 2024.

3. “Which Sectors Might Benefit from Rising Rates.” Charles Schwab, schwab.com/learn/story/which-sectors-might-benefit-fromrising-rates. Accessed 19 Jan. 2024.

4. Dolfing, Henrico. “Case Study: Nike i2 Supply Chain Management.” Henrico Dolfing, henricodolfing.com/2022/10/case-study-nike-i2-

supply-chain-management.html. Accessed 19 Jan. 2024.

5. Alper, Alexandra. “Nike Sales Likely to Suffer as Inflation Hits Sneakerheads.” Reuters, reuters.com/business/retail-consumer/nikesales-likely-suffer-inflation-hits-sneakerheads-2022-09-28/. Accessed 19 Jan. 2024.

6. Friedman, Nicole. “Argentina’s Inflation Surges After New President Cuts Subsidies.” The Wall Street Journal,

wsj.com/world/americas/argentinas-inflation-surges-after-new-president-cuts-subsidies-d8d304e2. Accessed 19 Jan. 2024.

7. Cohen, Luc. “Argentine Shoppers Face Daily Race for Deals as Inflation Soars Above 100%.” Reuters,

reuters.com/markets/argentine-shoppers-face-daily-race-deals-inflation-soars-above-100-2023-09-13/. Accessed 19 Jan. 2024.

8. “Navigating the Descent.” PIMCO, pimco.com/en-us/insights/economic-and-market-commentary/cyclical-outlook/navigating-thedescent. Accessed 19 Jan. 2024.